Maximize 2026 Unemployment Benefits: June 30th Cutoff Alert

The June 30th, 2026 deadline for unemployment benefits is fast approaching, making it critical for eligible individuals to understand and act on the steps required to maximize their financial support.

As the economic landscape continues to evolve, understanding your financial safety nets is more crucial than ever. This is particularly true for those relying on or potentially needing unemployment benefits. A significant deadline is on the horizon: the June 30th, 2026 unemployment benefits cutoff. This article will guide you through what you need to know to maximize your benefits before this critical date, ensuring financial stability for yourself and your family.

Understanding the 2026 Unemployment Benefits Landscape

The year 2026 brings with it specific regulations and deadlines concerning unemployment benefits. It’s essential to grasp the current framework to navigate the system effectively and ensure you receive all the support you are entitled to. These benefits are designed to provide temporary financial assistance to eligible workers who are unemployed through no fault of their own.

Federal and state programs often work in conjunction, creating a complex web of requirements and potential extensions. Staying informed about these nuances is the first step toward securing your financial well-being.

Federal and State Program Overviews

Unemployment benefits in the United States are primarily administered by state unemployment insurance agencies, following guidelines established by federal law. While federal legislation often provides a baseline, individual states have considerable leeway in determining specific eligibility criteria, benefit amounts, and duration.

- State-Specific Rules: Each state has its own unique set of rules regarding who qualifies, how much they receive, and for how long.

- Federal Enhancements: Historically, federal programs have supplemented state benefits during times of economic distress, offering extended periods or additional weekly payments.

- Eligibility Requirements: Generally, you must have worked a certain amount of time and earned a minimum amount of wages to be eligible.

It is vital to consult your specific state’s unemployment agency website for the most accurate and up-to-date information. Misinformation or outdated details can lead to delays or even denial of benefits, which could be financially detrimental.

Key Changes and Projections for 2026

The economic outlook for 2026 suggests a continued focus on workforce development and support for those transitioning between jobs. Government agencies are continuously evaluating and adjusting benefit programs to respond to labor market conditions. While broad federal extensions seen during previous crises may not be in place, targeted programs could emerge.

For example, some states might be experimenting with redesigned reemployment services or enhanced training opportunities tied to benefit receipt. These initiatives aim to not only provide financial aid but also to facilitate a quicker return to stable employment. Understanding these potential shifts will be key to leveraging all available resources.

The 2026 benefits landscape is shaped by ongoing economic recovery efforts and policy adjustments. Staying proactive in your research and understanding the specific provisions relevant to your state is paramount to maximizing your unemployment benefits.

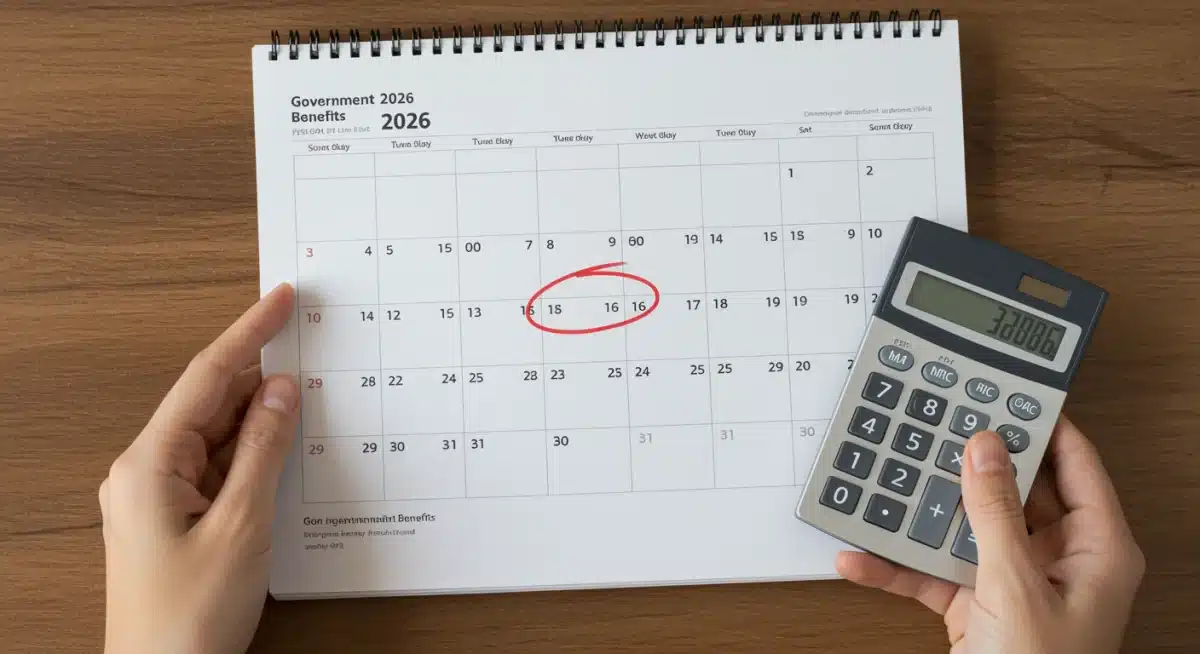

The Critical June 30th, 2026 Cutoff: What It Means for You

The June 30th, 2026 cutoff date is not just an arbitrary calendar mark; it represents a significant juncture for many individuals relying on unemployment assistance. This deadline could impact the availability of certain benefit programs, potential extensions, or even the application window for specific aid. Understanding its implications is crucial for strategic financial planning.

For some, this date might signify the end of an extended benefit period, while for others, it could be the final opportunity to apply for specific assistance before programs are phased out. Proactive engagement with this deadline is essential to avoid any lapse in financial support.

Decoding the Deadline’s Impact

The June 30th, 2026 cutoff primarily refers to the expiration of certain federal or state-level unemployment benefit enhancements or specific program windows. It’s not necessarily a universal termination of all unemployment benefits, but rather a potential end to specific provisions that might have offered additional weeks of aid or higher weekly amounts.

- Program Expiration: Some temporary pandemic-era programs or state-specific initiatives might conclude on this date.

- Benefit Reductions: It could mean a return to standard state-level benefit durations or amounts, which are typically shorter and lower than enhanced benefits.

- Application Window Closure: For specific, time-limited programs, June 30th, 2026, might be the last day to initiate an application.

It is imperative to verify with your state’s unemployment department precisely which programs or provisions are affected by this specific date. General assumptions could lead to missed opportunities or unexpected financial shortfalls.

Who is Most Affected?

Individuals who have been receiving extended benefits or those whose claims are currently nearing the maximum duration under standard state programs might be most affected. Furthermore, those who have recently become unemployed and are considering applying for benefits should be particularly aware of this deadline, as it may influence the terms of their potential assistance.

Workers in sectors still experiencing slower recovery or those facing long-term unemployment due to structural changes in the economy should also pay close attention. The cutoff could remove a critical safety net, necessitating alternative financial strategies.

The June 30th, 2026 cutoff is a pivotal date that demands immediate attention and diligent research. Understanding its specific impact on your situation is the cornerstone of effective financial planning during unemployment.

Eligibility and Application: Your Roadmap to Benefits

Navigating the eligibility requirements and the application process for unemployment benefits can often feel daunting. However, a clear understanding of these steps is fundamental to successfully securing the financial assistance you need. The general principle remains consistent: benefits are for those who are unemployed through no fault of their own and are actively seeking work.

Before the June 30th, 2026 cutoff, ensuring your eligibility and submitting a complete application without errors is paramount to avoiding delays and maximizing your potential benefits.

Key Eligibility Criteria for 2026

While specific criteria vary by state, several common factors determine eligibility for unemployment benefits. These typically revolve around your past employment history and current availability for work.

- Work History: You must have worked a certain amount of time, usually measured in quarters, and earned a minimum amount of wages during a “base period.”

- Reason for Unemployment: You must be unemployed through no fault of your own, meaning you were laid off, your position was eliminated, or you resigned for good cause.

- Availability for Work: You must be able, available, and actively seeking suitable employment.

It’s crucial to be honest and accurate when providing information about your work history and reasons for separation from your last job. Any discrepancies can lead to investigations and potential denial of benefits.

Streamlining Your Application Process

Applying for unemployment benefits can be a multi-step process, often requiring detailed documentation. Starting early and being organized can significantly reduce stress and speed up approval times. Before you begin, gather all necessary documents.

This includes your Social Security number, driver’s license or state ID, mailing address, employment history for the past 18-24 months (including employer names, addresses, phone numbers, and dates of employment), and the reason for separation from your last job. Having this information readily available will make the online application smoother.

Many states now offer online application portals, which are generally the fastest and most efficient way to apply. Be sure to double-check all information before submitting. After submission, regularly check your application status and respond promptly to any requests for additional information from your state’s unemployment agency.

Understanding and meeting eligibility criteria, alongside a thorough and timely application, are vital steps in securing your unemployment benefits, especially with the June 30th, 2026 deadline approaching.

Strategies to Maximize Your Benefits Before June 30th

With the June 30th, 2026 cutoff looming, a proactive approach to managing your unemployment benefits is essential. Maximizing your potential aid involves more than just applying; it requires strategic planning, diligent record-keeping, and an understanding of potential avenues for extension or additional support. Every step you take now can significantly impact your financial stability.

Don’t wait until the last minute to assess your situation and explore all available options. Early action is key to navigating this critical period effectively.

Exploring Potential Extensions and Additional Programs

Even if a general program is set to expire, there might be specific circumstances or subsequent legislation that could offer extensions or alternative forms of assistance. It’s crucial to stay informed about these possibilities.

- State-Specific Extensions: Some states may implement their own extended benefit programs based on local economic conditions, even if federal enhancements cease.

- Training Programs: Certain unemployment programs are linked to re-training initiatives. Enrolling in approved training could potentially extend your benefit period.

- Disaster Unemployment Assistance: If your unemployment is linked to a federally declared disaster, separate assistance might be available.

Regularly check your state’s unemployment agency website and subscribe to their newsletters or alerts. These are often the first places to announce new programs or extensions. Networking with career counselors or community organizations can also provide valuable insights into local support systems.

Tips for Effective Claim Management

Managing your unemployment claim effectively can prevent delays and ensure you receive your benefits without interruption. This involves meticulous record-keeping and prompt responses.

Keep detailed records of all your job search activities, including dates, companies contacted, positions applied for, and interview outcomes. This documentation is often required when certifying for weekly benefits and can be crucial if your claim is ever reviewed or challenged. Also, promptly respond to any communication from the unemployment agency, whether it’s a request for more information or an appeal notice.

Understanding and leveraging all available resources, alongside diligent claim management, are critical strategies to maximize your unemployment benefits and mitigate the impact of the June 30th, 2026 cutoff.

Financial Planning Beyond Unemployment Benefits

While unemployment benefits provide a vital safety net, they are by definition temporary. As the June 30th, 2026 cutoff approaches, it becomes increasingly important to develop a robust financial plan that extends beyond the duration of these benefits. Proactive financial management can significantly reduce stress and ensure long-term stability.

Thinking ahead and preparing for a period without unemployment assistance is a responsible and empowering step towards securing your future, regardless of your current employment status.

Budgeting and Expense Management

Creating and sticking to a realistic budget is the cornerstone of managing your finances during unemployment. Start by clearly listing all your income sources, including any remaining benefits, and then itemize all your expenses.

- Distinguish Needs vs. Wants: Prioritize essential expenses like housing, food, utilities, and healthcare. Cut back on non-essential spending.

- Track Spending: Use budgeting apps or spreadsheets to monitor where your money is going. This helps identify areas for further reduction.

- Emergency Fund: If possible, allocate any available funds to build or bolster an emergency savings account. Even a small amount can provide a buffer.

Regularly review your budget and adjust it as your financial situation changes. The goal is to make your existing funds last as long as possible while you seek new employment.

Exploring Alternative Income Streams

Relying solely on unemployment benefits can be risky, especially as the cutoff date nears. Explore other avenues for income, even if they are temporary or part-time.

Consider part-time work, freelancing, or gig economy opportunities that align with your skills and availability. These can provide supplemental income, keep your skills sharp, and potentially lead to full-time employment. Additionally, review any assets you might have that could be temporarily utilized or monetized, such as selling unused items or renting out a spare room.

Proactive financial planning that includes stringent budgeting and the exploration of alternative income streams is vital for maintaining stability and peace of mind long after your unemployment benefits conclude.

Reemployment and Skill Development in 2026

The ultimate goal for anyone receiving unemployment benefits is a swift return to stable employment. In 2026, the job market is dynamic, emphasizing adaptability and continuous learning. Focusing on reemployment strategies and skill development is not just about finding a new job; it’s about building a resilient career path for the future. The impending June 30th, 2026 cutoff underscores the urgency of these efforts.

Investing in your professional growth now can pay significant dividends, opening doors to new opportunities and enhancing your long-term earning potential.

Leveraging Career Resources and Training Programs

Many government agencies and non-profit organizations offer free or low-cost resources to assist job seekers. These can be invaluable tools in your reemployment journey.

- Workforce Development Centers: These centers often provide resume writing assistance, interview coaching, and access to job listings.

- Online Learning Platforms: Utilize platforms offering courses in high-demand skills, often at reduced costs or even for free through public library partnerships.

- Vocational Training: Explore vocational schools or community colleges for certifications in trades or technical fields experiencing labor shortages.

Actively participating in these programs not only enhances your marketability but can also demonstrate your commitment to potential employers. Some states even link participation in approved training programs to extended unemployment benefits, so inquire about such possibilities.

Networking and Job Search Strategies for the Modern Market

The job search landscape in 2026 is highly digital and interconnected. Effective networking and modern job search strategies are crucial for standing out.

Update your professional online profiles, such as LinkedIn, ensuring they reflect your current skills and career aspirations. Actively engage with industry groups and virtual career fairs. Don’t underestimate the power of informational interviews, where you connect with professionals in your target field to gain insights and expand your network.

Tailor your resume and cover letter for each application, highlighting how your skills and experience directly align with the job requirements. Practice your interview skills, including virtual interview etiquette, as many initial interviews are conducted remotely. A multi-faceted approach to job searching, combining online applications with networking and skill development, will significantly improve your chances of reemployment.

| Key Aspect | Brief Description |

|---|---|

| June 30th, 2026 Cutoff | Critical deadline for certain unemployment benefit programs or extensions; requires immediate action. |

| Eligibility Check | Verify state-specific work history, reason for unemployment, and availability for work criteria. |

| Maximize Benefits | Explore extensions, training programs, and meticulous claim management for full entitlement. |

| Financial Planning | Develop a budget, manage expenses, and identify alternative income streams beyond benefits. |

Frequently Asked Questions About 2026 Unemployment Benefits

The June 30th, 2026 cutoff refers to the potential expiration of specific federal or state-level unemployment benefit enhancements or the closing of application windows for certain programs. It’s crucial to check with your state’s unemployment agency for detailed information on which specific provisions are affected by this date.

Eligibility typically depends on your work history, earnings during a base period, and the reason for your unemployment. Each state has specific criteria. The best way to check is by visiting your state’s official unemployment insurance website and reviewing their detailed eligibility guidelines or starting an application.

Potentially, yes. Some states may offer extended benefits based on economic conditions or if you enroll in approved training programs. Federal extensions can also be enacted during severe economic downturns. Consult your state’s unemployment office for current information on available extensions or alternative programs.

You’ll typically need your Social Security number, driver’s license or state ID, mailing address, and detailed employment history for the past 18-24 months, including employer names, addresses, phone numbers, and dates of employment. Having these ready will streamline your application process significantly.

If your benefits end, focus on a robust financial plan, including strict budgeting and exploring alternative income streams like part-time work or freelancing. Leverage career resources, skill development programs, and networking opportunities to accelerate your job search and secure new employment.

Conclusion

The approaching June 30th, 2026 cutoff for unemployment benefits serves as a critical reminder for individuals to actively manage their financial futures. By understanding current regulations, meticulously navigating eligibility and application processes, and proactively seeking extensions or alternative support, you can maximize your financial stability. Beyond benefits, adopting sound financial planning, exploring diverse income streams, and investing in reemployment through skill development and robust job search strategies are paramount. Taking these steps now ensures you are well-prepared for any economic shifts and can forge a path towards lasting financial security.