US Jobless Rate 3.9% in Jan 2025: Sector Analysis & Impact

The US jobless rate maintained a 3.9% level in January 2025, reflecting a resilient labor market amidst ongoing economic shifts, with detailed sector-specific performances influencing the overall financial landscape.

The US jobless rate for January 2025 has been a focal point of economic discussion, with the Bureau of Labor Statistics reporting that it held steady at 3.9%. This figure, while seemingly consistent, masks a dynamic labor market undergoing significant transformations and presenting both opportunities and challenges for American workers and businesses alike.

Understanding the nuances behind this headline number requires a deeper dive into sector-specific performance, recent updates, and the broader financial implications. As we navigate the complexities of the current economic climate, a comprehensive analysis of these factors becomes crucial for informed decision-making.

Understanding the January 2025 Unemployment Report

The latest unemployment report for January 2025 offers a critical snapshot of the national labor market, revealing that the jobless rate remained at 3.9%. This stability, following a period of fluctuating economic indicators, suggests a labor market that is both resilient and adapting to evolving conditions. The report details various metrics beyond the headline rate, including labor force participation and average hourly earnings, which collectively paint a more complete picture.

Examining these underlying figures is essential to grasp the full scope of the economic health. While a consistent unemployment rate often signals stability, it’s important to consider how different demographics and industries are experiencing the job market. This includes looking at factors such as the duration of unemployment and the reasons for job separation, which can offer insights into the structural aspects of unemployment.

Key Metrics and Their Significance

- Labor Force Participation Rate: This metric indicates the percentage of the working-age population currently employed or actively seeking employment. A stable or increasing rate suggests confidence in the job market.

- Average Hourly Earnings: Growth in average hourly earnings is a key indicator of wage inflation and consumer purchasing power, directly impacting household finances.

- Unemployment by Demographics: Analyzing jobless rates across different age groups, genders, and racial/ethnic backgrounds helps identify disparities and areas needing targeted policy interventions.

- Duration of Unemployment: This metric reveals whether job seekers are finding employment quickly or if extended periods of joblessness are becoming more common, signaling potential structural issues.

The January 2025 report underscores the ongoing recovery and rebalancing of the economy post-pandemic. While the overall jobless rate holds firm, the underlying data points to a complex interplay of forces shaping the employment landscape, from technological advancements to shifting consumer demands. This requires careful consideration when assessing the true health of the labor market.

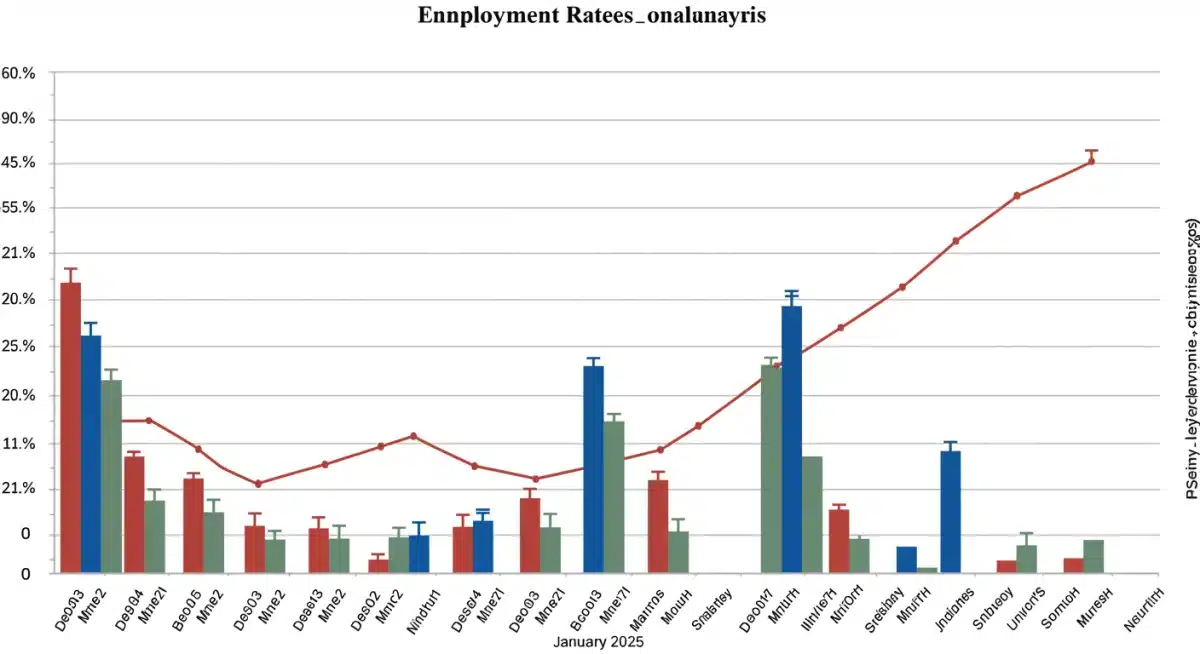

Sector-Specific Analysis: Winners and Losers

Delving into the sector-specific data from the January 2025 unemployment report reveals a varied landscape across different industries. While some sectors continue to experience robust job growth and low unemployment, others are facing headwinds, leading to job losses or stagnant employment figures. This disaggregated view is crucial for understanding where economic strength lies and where vulnerabilities might emerge.

The report highlights significant shifts in employment patterns, influenced by technological advancements, evolving consumer behavior, and global economic trends. Sectors tied to digital innovation and services continue to thrive, while those reliant on traditional models or facing increased automation may be struggling to adapt. This dynamic creates a challenging environment for policymakers and job seekers alike.

Thriving Industries in Early 2025

Several sectors demonstrated remarkable resilience and growth in January 2025, contributing positively to the overall employment picture. These industries often leverage innovation and meet growing demands in the digital age.

- Technology and AI: Continued expansion in software development, data science, and artificial intelligence roles.

- Healthcare and Social Assistance: Steady demand for healthcare professionals and support staff, driven by an aging population and ongoing public health needs.

- Renewable Energy: Significant investment and job creation in solar, wind, and other clean energy technologies.

- Logistics and E-commerce: Sustained growth in warehousing, transportation, and delivery services due to online retail expansion.

Conversely, some sectors experienced contractions or slower growth. These areas often face challenges from automation, supply chain disruptions, or shifts in consumer spending habits. Understanding these divergences is vital for predicting future economic trends and guiding workforce development initiatives.

Sectors Facing Challenges

Not all industries shared in the positive employment trends. Some sectors reported job losses or slower hiring, indicating areas of concern within the broader economy.

- Traditional Retail: Ongoing pressure from e-commerce, leading to store closures and reduced staffing.

- Manufacturing (specific segments): Automation and global competition continue to impact certain manufacturing sub-sectors.

- Real Estate and Construction: Higher interest rates and cooling housing markets have led to some slowdowns in these areas.

The varied performance across sectors underscores the importance of a nuanced understanding of the labor market. While the aggregate jobless rate provides a general overview, the detailed sector analysis offers actionable insights into the specific drivers of employment trends and economic health.

Recent Updates and Economic Indicators

Beyond the headline US jobless rate, several other economic indicators provide valuable context for the January 2025 report. These updates help to paint a more comprehensive picture of the economic landscape, influencing market sentiment and policy decisions. Understanding these interconnected factors is essential for any thorough analysis of the labor market’s health.

Inflation, consumer spending, and manufacturing output are just a few of the key metrics that interact with employment figures. A stable jobless rate, for instance, might be viewed differently if inflation is soaring or if consumer confidence is plummeting. These broader economic signals can either reinforce or contradict the apparent stability suggested by unemployment numbers.

Key Economic Metrics Influencing the Job Market

- Inflation Rates: Persistent inflation can erode purchasing power, impacting consumer demand and, subsequently, hiring decisions.

- Consumer Confidence Index: A measure of how optimistic consumers are about the state of the economy, directly influencing spending and investment.

- Manufacturing PMI: The Purchasing Managers’ Index for manufacturing provides insight into the health of the industrial sector, which can be a leading indicator for broader economic activity.

- Interest Rate Policy: Decisions by the Federal Reserve regarding interest rates can significantly affect borrowing, investment, and ultimately, job creation.

The January 2025 report is also set against a backdrop of ongoing geopolitical developments and technological advancements, both of which have profound implications for the economy. Supply chain resilience, energy prices, and the pace of digital transformation all play a role in shaping labor market dynamics. Policymakers and businesses must consider these external factors when planning for the future.

Moreover, the influx of new graduates into the workforce and shifts in immigration policies can impact labor supply and demand. These demographic changes, coupled with evolving skill requirements, contribute to the complexity of the current job market. Staying abreast of these varied updates is crucial for a holistic understanding of the economic environment.

Financial Impact on Households and Businesses

The stability of the US jobless rate at 3.9% in January 2025 carries substantial financial implications for both American households and businesses. A relatively low and stable unemployment rate generally translates to greater job security and stable incomes for many, fostering consumer confidence and spending. However, the picture is not uniformly positive, as sector-specific variations can lead to uneven impacts.

For households, sustained employment means continued ability to meet financial obligations, save, and invest. This stability can reduce stress and improve overall quality of life. Conversely, those in sectors experiencing downturns may face financial hardship, requiring careful budgeting and potentially seeking new skills or career paths. The broader economic health, as reflected in the unemployment report, directly influences financial planning and stability.

Impact on Households

- Consumer Spending: A stable job market generally leads to consistent income, boosting consumer spending on goods and services, which is a major driver of economic growth.

- Debt Management: Steady employment allows households to better manage existing debts and avoid accumulating new ones, contributing to financial stability.

- Savings and Investments: With secure incomes, individuals are more likely to save for the future and invest in retirement accounts or other financial instruments.

- Housing Market: Employment stability indirectly supports the housing market by ensuring more people can afford mortgages and maintain their homes.

For businesses, a stable labor market can mean a more predictable talent pool and less turnover, but it can also lead to increased wage pressures as competition for skilled workers intensifies. Businesses might need to adjust their compensation strategies to attract and retain top talent, which can impact profitability and operational costs.

The financial health of businesses is often a direct reflection of the broader economic conditions. Positive employment trends can signal strong demand for products and services, encouraging businesses to expand and invest further. Conversely, challenges in specific sectors can lead to reduced investment and hiring freezes.

Impact on Businesses and the Economy

Businesses benefit from a stable workforce, but also face challenges related to labor costs and skill gaps. The overall economic impact is a delicate balance of these forces.

- Labor Costs: A tight labor market can drive up wages, impacting business profitability but also increasing consumer purchasing power.

- Talent Acquisition: Companies may face increased competition for skilled workers, requiring innovative recruitment and retention strategies.

- Investment and Expansion: Stable economic conditions encourage businesses to invest in new projects and expand operations, creating more jobs.

- Supply Chain Stability: A healthy labor market can contribute to more stable supply chains by ensuring adequate staffing for production and logistics.

Ultimately, the financial implications of the January 2025 unemployment report are multifaceted. While overall stability is reassuring, the uneven distribution of job growth and challenges across sectors necessitates a nuanced approach to financial planning for both individuals and corporations.

Comparing January 2025 to Previous Periods

To truly appreciate the significance of the US jobless rate holding at 3.9% in January 2025, it is essential to compare this figure with unemployment reports from previous periods. This historical context allows for a more informed assessment of current trends, revealing whether the labor market is strengthening, weakening, or maintaining a steady course over time. Such comparisons help identify long-term patterns and deviations from historical norms.

Looking back at the past year, or even several years, can highlight periods of rapid job growth, economic downturns, and the effectiveness of various economic policies. For instance, comparing the current rate to peak unemployment during the pandemic or previous recessions provides a clear measure of recovery and resilience. These comparisons are vital for economists, policymakers, and the public alike to understand the trajectory of the economy.

Year-over-Year Analysis

Comparing January 2025’s 3.9% jobless rate to January 2024 offers insights into the year-on-year performance of the labor market. If the rate has decreased, it indicates job growth; if it has increased, it suggests a slowdown. This annual perspective helps to filter out seasonal variations and provides a clearer long-term trend.

- January 2024: Understanding the rate from the previous year helps establish a baseline for evaluating current performance.

- Trends in Job Creation: Analyzing the net job creation figures month-over-month and year-over-year provides insight into the pace of economic expansion.

- Wage Growth Comparison: Comparing wage growth rates from previous periods indicates whether real wages are keeping pace with inflation or improving purchasing power.

Furthermore, examining pre-pandemic unemployment levels can offer a benchmark for what a ‘healthy’ labor market might look like in the current economic environment. While the economy has undergone structural changes, these historical benchmarks can still provide valuable context for assessing current performance and future outlooks.

Long-Term Trends and Economic Cycles

Beyond immediate year-over-year comparisons, placing the January 2025 data within the context of longer economic cycles offers a broader perspective. Economic cycles, characterized by periods of expansion and contraction, influence unemployment rates significantly. Understanding where the current economy stands within such a cycle is crucial for forecasting future trends.

- Recessionary Periods: Comparing current rates to those during past recessions illustrates the economy’s ability to recover and sustain employment.

- Periods of Expansion: Observing how the jobless rate behaves during sustained economic growth phases helps define what constitutes full employment.

The stability observed in January 2025, when viewed historically, suggests a mature phase of economic expansion, where significant drops in unemployment become less frequent, but job growth remains steady. This historical perspective is indispensable for a complete understanding of the current labor market dynamics.

Policy Implications and Future Outlook

The consistent US jobless rate of 3.9% in January 2025 carries significant implications for economic policy and the future outlook of the American economy. Policymakers, including the Federal Reserve and legislative bodies, closely monitor these figures to make informed decisions regarding monetary policy, fiscal spending, and workforce development initiatives. The stability suggests a delicate balance, requiring careful consideration of potential interventions.

A stable unemployment rate in a dynamic economy presents both opportunities and challenges. On one hand, it could indicate that current policies are effectively managing economic growth without overheating the labor market. On the other hand, it might signal underlying issues such as skill gaps or structural unemployment that require targeted policy responses to ensure long-term economic health and inclusive growth.

Monetary Policy Considerations

The Federal Reserve analyzes unemployment data as a key input for its monetary policy decisions, particularly regarding interest rates. A stable jobless rate suggests that the economy is near full employment, which might influence the Fed’s stance on inflation control.

- Interest Rate Decisions: The Federal Reserve may maintain current interest rates or consider adjustments based on inflation trends and labor market stability.

- Quantitative Easing/Tightening: The Fed’s balance sheet policies are also influenced by employment data, aiming to support economic growth without creating excessive inflationary pressures.

Fiscal policy, enacted by Congress and the administration, also plays a crucial role. Government spending on infrastructure, education, or social programs can directly impact job creation and workforce development. The January 2025 report provides data that can inform these budgetary decisions.

Fiscal Policy and Workforce Development

Government initiatives aimed at bolstering specific sectors or addressing unemployment disparities are often shaped by detailed labor market reports. These policies seek to ensure that all segments of the population have opportunities for employment and skill development.

- Infrastructure Spending: Investments in public works can create numerous jobs across construction, engineering, and related sectors.

- Education and Training Programs: Policies focused on upskilling and reskilling the workforce are vital for addressing skill gaps in evolving industries.

- Targeted Employment Programs: Initiatives designed to assist specific demographic groups or regions with higher unemployment rates can promote more equitable job growth.

Looking ahead, the future outlook for the US job market will depend on a confluence of factors, including technological advancements, global economic conditions, and domestic policy choices. Maintaining a low and stable jobless rate while fostering inclusive growth will be a primary objective for policymakers in the coming months and years.

Strategies for Job Seekers and Employers

In light of the US jobless rate holding at 3.9% in January 2025, both job seekers and employers need to adapt their strategies to navigate the evolving labor market. For job seekers, this stable yet competitive environment means focusing on in-demand skills and effective job search techniques. For employers, it necessitates innovative approaches to talent acquisition and retention amidst a tight labor market.

The sector-specific insights from the unemployment report are particularly valuable here. Job seekers can target growing industries, while employers in struggling sectors may need to rethink their business models or invest in retraining their workforce. Understanding these dynamics is crucial for success in the current economic climate.

Advice for Job Seekers

Job seekers should leverage the available data to position themselves advantageously. Focusing on continuous learning and networking can open up new opportunities.

- Skill Development: Identify and acquire skills that are in high demand, particularly in thriving sectors like technology, healthcare, and green energy.

- Networking: Actively engage with professionals in target industries through online platforms, industry events, and informational interviews.

- Tailored Applications: Customize resumes and cover letters to specific job requirements, highlighting relevant experience and skills.

- Utilize Online Resources: Leverage online job boards, professional networking sites, and career development platforms to find suitable opportunities.

Employers, on the other hand, face the challenge of attracting and retaining talent in a market where skilled workers may have multiple options. This requires a focus on competitive compensation, a positive work environment, and opportunities for professional growth.

Strategies for Employers

To thrive in a stable labor market, employers must prioritize employee satisfaction and development. This includes offering attractive benefits and fostering a culture of continuous learning.

- Competitive Compensation: Offer salaries and benefits packages that are competitive within their industry and geographic location to attract top talent.

- Employee Development: Invest in training and development programs to upskill existing employees and address internal skill gaps.

- Flexible Work Arrangements: Consider offering remote or hybrid work options, which are highly valued by many job seekers, to broaden the talent pool.

- Positive Company Culture: Foster a supportive and inclusive work environment that encourages employee engagement and reduces turnover.

By adopting these proactive strategies, both job seekers and employers can effectively navigate the dynamics of the January 2025 labor market, contributing to individual career success and overall economic growth.

| Key Point | Brief Description |

|---|---|

| Jobless Rate Stability | The US jobless rate held steady at 3.9% in January 2025, indicating a resilient labor market. |

| Sectoral Divergence | Significant variations in employment trends across different industries, with tech and healthcare thriving. |

| Financial Implications | Stable employment boosts consumer spending and household finances, but wage pressures affect businesses. |

| Policy Response | Policymakers consider data for monetary and fiscal decisions, focusing on sustained growth and skill development. |

Frequently Asked Questions About the US Jobless Rate

A 3.9% jobless rate generally signifies a healthy and stable labor market, indicating that most people who want to work are able to find jobs. It suggests sustained economic activity and consumer confidence, while also potentially hinting at wage pressures as the demand for labor remains strong.

In January 2025, key sectors like technology and AI, healthcare and social assistance, renewable energy, and logistics and e-commerce demonstrated significant job growth. These industries continue to benefit from ongoing innovation, demographic shifts, and evolving consumer demands.

A 3.9% jobless rate is historically low, comparable to pre-pandemic levels and significantly below the long-term average. This indicates a robust labor market, reflecting strong recovery and sustained economic expansion compared to previous decades and recessionary periods.

For average American households, a stable 3.9% jobless rate typically means greater job security and consistent income. This supports consumer spending, allows for better debt management, and encourages savings and investments, contributing to overall financial stability and confidence.

Despite its benefits, a stable low jobless rate can present challenges such as increased wage inflation due to labor scarcity, skill gaps in specific industries, and intensified competition for talent among employers. It may also mask underlying structural unemployment issues that require targeted policy interventions.

Conclusion

The January 2025 unemployment report, revealing a steadfast US jobless rate of 3.9%, paints a picture of a resilient yet complex labor market. This stability, while broadly positive, is characterized by significant variations across different economic sectors, demanding a nuanced understanding of its implications. From the thriving tech and healthcare industries to the challenges faced by traditional retail, the report underscores the dynamic nature of employment in the United States.

The financial impact resonates across households and businesses, influencing everything from consumer spending to investment strategies. Policymakers are closely monitoring these trends, using the data to inform decisions on monetary and fiscal policies aimed at sustaining growth and addressing disparities. For individuals and organizations alike, adapting to these evolving conditions through continuous skill development and strategic hiring practices will be paramount to navigating the future economic landscape successfully.